“Central banks have thrown everything at their economies, and yet the results have been disappointing,” he notes.

In spite of the “biggest monetary policy stimulus in the history of the world” the results have been anaemic. Instead, King ranges more widely, framing his argument around not just the dramas of that period but also the decade of lost growth that has followed. He baldly states: “No doubt there were bankers who were indeed wicked and central bankers who were incompetent, though the vast majority of both whom I met during the crisis were neither.” Many (myself included) might beg to disagree, but this argument has exhausted itself. He says he is not interested in the blame game, which is probably just as well considering that he was governor of the Bank of England at the time of the great crash of 2007-08. He avoids the hubris of the “I told you so” school (virtually none of them actually did tell us so ahead of time).

Not for him is the Piketty-esque grand sweep. It is in this vein that he probes the state of the global economy his diagnosis does not reassure.

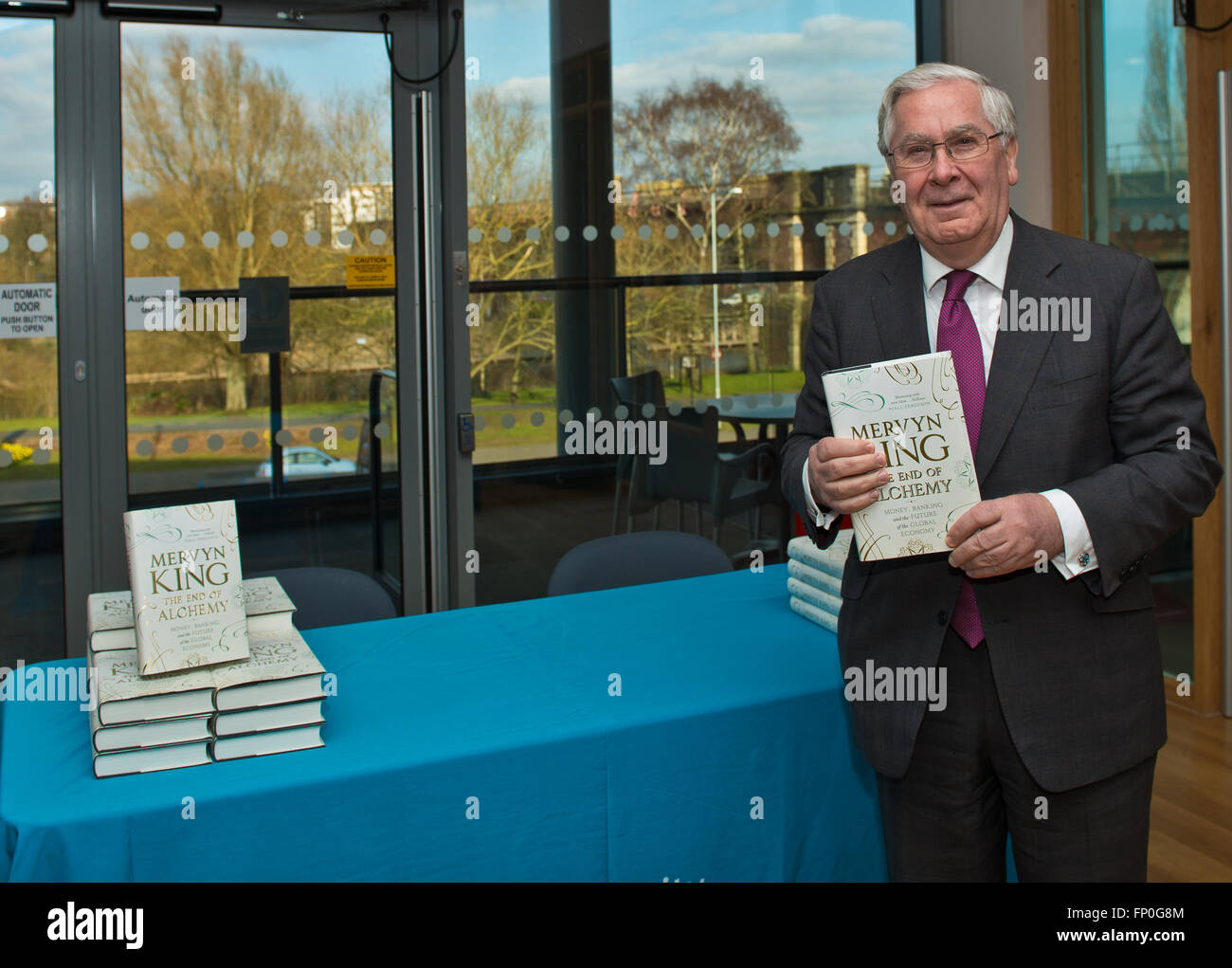

Or he could be a GP telling you that you really need to exercise more and go easy on the carbs. Mervyn King looks like one of those old-fashioned bank managers who cast a paternalistic eye on the nervous customer.

0 kommentar(er)

0 kommentar(er)